Introduction

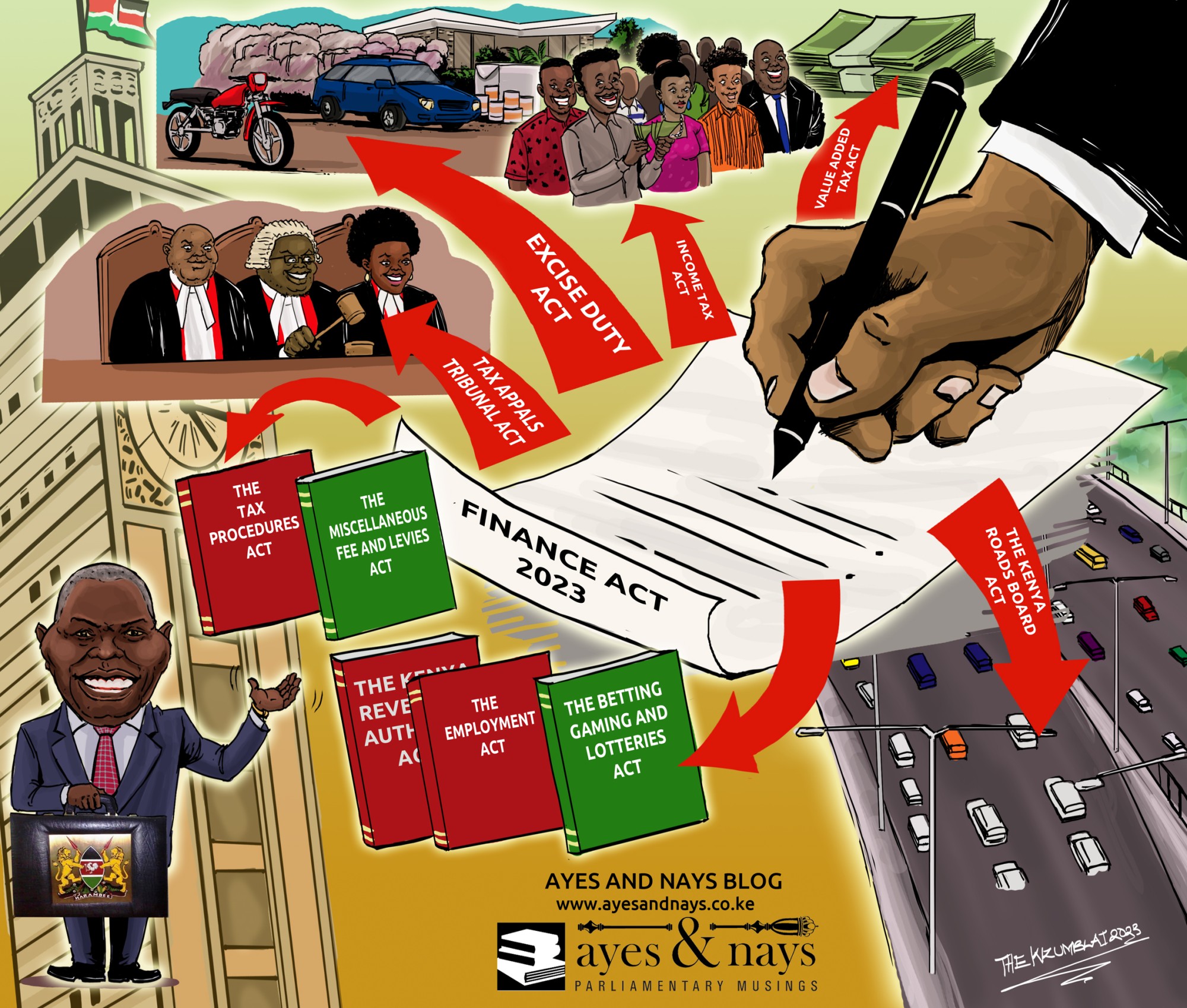

The Finance Act, 2023, was assented to by the President on 26th June, 2023. The Act contains 102 sections. The Finance Bill, as it was then, was passed by the National Assembly on 21st June,2023.

Highlights of the Act

The Act proposes amendments to the following tax laws to enhance efficiency and administration in national revenue mobilization:

- The Income Tax Act (Cap.470);

- The Value Added Tax Act (No. 35 of 2013);

- The Tax Appeals Tribunal Act (No. 40 of 2013);

- The Excise Duty Act (No. 23 of 2015);

- The Tax Procedures Act (No. 29 of 2015); and

- The Miscellaneous Fees and Levies Act (No. 29 of 2016).

The Act also amends the following additional laws:

- The Betting, Gaming and Lotteries Act (Cap.131);

- The Kenya Roads Board Act, 1999 (No. 7 of 1999);

- The Kenya Revenue Authority Act, 1995 (No. 2 of 1995);

- The Employment Act, 2007 (No. 11 of 2007);

- The Unclaimed Financial Assets Act (No. 40 of 2011);

- The Statutory Instruments Act, 2013 (No. 23 of 2013); and

- The Retirement Benefits (Deputy President and Designated State Officers) Act, 2015 (No. 8 of 2015).

Amendments to the Income Tax Act (Cap. 470)

The Act amends the Income Tax Act (Cap. 470) (“ITA”). Some of the proposed amendments include:

- Amendment of Section 2 of the ITA to amend the definition of “winnings” and insert new definitions of “digital content monetization”, “immovable property” and “related person”.

- Amendment of Section 4A of the ITA to allow realised foreign exchange loss that is disallowed in the first year to be deducted for a period not exceeding five years from the date it was disallowed. This will apply to a company whose interest payment to a non-resident person exceeds 30% of earnings before interest, taxes and amortization.

- Amendment of Section 5 of the ITA to exclude from income tax mileage claims or payments for travelling to perform official duties, include club entrance and subscription fees allowed against employer’s income as taxable income of the employee, and to defer taxation of gains from employee share ownership plan for start-ups for five years or at the time employee exit the start up company or dispose the shares.

- Insertion of new Section 7B to introduce tax on repatriated income and the formula for ascertaining the tax.

- Amendment of new Section 12C of ITA to retain the lower threshold at one million shillings and to lower the upper threshold for the turnover tax for businesses from fifty million shillings to twenty-five million shillings to expand the tax base and to protect small scale traders.

- Insertion of new Section 12F to introduce Digital Asset Tax payable by a person on income derived from the transfer or exchange of digital assets.

- Amendment of Section 21 of ITA to make incomes of clubs and associations taxable excluding annual contributions and joining fees.

- Insertion of new Section 31A that provides for relief the contributions made to post-retirement medical fund to encourage savings towards post-retirement decent healthcare services.

- Amendment of Section 35 of the ITA to introduce withholding tax on sales promotion, marketing and advertising services; digital content monetisation; appointment of rental income agents to withhold tax on behalf of the Commissioner and to require that the withheld rental income tax be submitted within five working days.

Amendment of the First Schedule to ITA

- To provide withholding tax exemption for royalties paid to a non-resident person by a company undertaking the manufacture of human vaccines

- To provide withholding tax exemption for interest paid to a resident person or non-resident person by a company undertaking the manufacture of human vaccines

- To exempt from tax investment income from a post-retirement medical fund, and payment in the form of funds transfer from a post-retirement medical fund to a medical insurance cover provider.

- To exempt from tax income earned by contactors, sub-contractors and employees implementing a project financed by 100% grant.

- To exempt from tax gains on transfer of property within a special economic zone enterprise, developer and operator.

- To exempt from tax royalties, interest, management fees, professional fees, training fees, consultancy fee, agency or contractual fees paid by a special economic zone developer, operator or enterprise, in the first 10 years of its establishment, to a non-resident person.

Amendment of the Second Schedule to ITA to provide for investment allowance on industrial building and docks at the rate of 10%.

Amendment of the Third Schedule to ITA

- To provide for post-retirement medical fund relief at 15% of the amount contributed or Ksh. 60,000 per annum, whichever is lower.

- To provide adjustment of rates of P.A.Y.E tax as follows; 10% on the first Ksh. 288,000; 25% on the next Ksh. 100,000; 30% on the next Ksh. 5,612,000; 32.5% on the next Kshs. 3,600,000 and 35% on all income over Ksh. 9,600,000. This is aimed at making the P.A.Y.E bands progressive.

- To reduce the non-resident rates of corporation tax from 37.5% to 30% so as to remove discrimination in taxation of company profits.

- Provide for reduced rate of 10% tax for companies manufacturing human vaccines.

- To reduce withholding tax on rental income of property from 10% to 7.5%.

- To provide for the tax rate for digital content monetisation for residents at 5% and for non-residents at 20% of the gross amount.

- To provide for tax rate for repatriated income for non-residents at 15%.

- To provide for the tax rate for sales promotion, marketing and advertising services at 5% of the gross amount.

- To increase advance tax for vans, pick-ups, trucks, prime movers, trailers and lorries from one thousand five hundred shillings per tonne of load capacity per year to two thousand five hundred shillings.

- To increase advance tax for saloons, station-wagons, mini-buses and coaches from sixty shillings per passenger capacity per month to one hundred shillings.

- To increase the turnover tax from 1% of the gross receipts to 3%.

- To provide the rate for digital assets tax at 3% of the transfer of exchange value of the digital asset.

Amendment of the Fourth Schedule to ITA to exempt from tax the interest payable to Mortgage refinance companies.

Amendment of the Eighth Schedule to ITA to provide for taxation of gains, due date for tax payable and the time period of existence of a property involved in transfer in cases of internal restructuring.

Amendment of the Ninth Schedule to ITA t to increase the ownership threshold from 10% to 20% where the contractor needs to notify the Commissioner.

Amendments to the Value Added Tax Act

The Act amends the Value Added Tax Act (No. 35 of 2013) as follows:

- To remove the lower rate of 8% applicable to liquefied petroleum gas and petroleum products to make them subject to VAT at standard rate of 16%.

- To provide an exemption from VAT medicaments containing alkaloids for retail sale, infusion solutions for ingestion for retail sale, white absorbent cotton wadding for retail sale.

- To provide an exemption from VAT taxable goods for construction and equipping of specialized hospitals with a minimum bed capacity of fifty.

- To classify taxable food supplies for school feeding programme as exempt supplies.

- To zero-rate the following supplies:

—Liquified Petroleum gas.

—All tea and coffee locally purchased for the purpose of value addition before exportation subject to approval by the Commissioner-General.

—The supply of locally assembled and manufactured mobile phones.

—The supply of motorcycles of tariff heading 8711.60.00

—The supply of lithium ion batteries.

—The supply of electric buses of tariff heading 87.02.

—Inputs or raw materials locally purchased or imported for the manufacture of animal feeds.

—Bioethanol vapour (BEV) Stoves (cooking appliances and plate warmers for liquid fuel).

—Inbound international sea freight offered by a registered person.

Amendments to the Tax Appeals Tribunal Act

The Act amends the Tax Appeals Tribunal Act (No. 40 of 2013) to clarify on the documentation required when filing a notice of appeal and to define the term “appealable decision” to make it clear the decision that a taxpayer can appeal.

Amendments to the Excise Duty Act

The Act amends the Excise Duty Act (No. 23 of 2015) as follows:

- It repeals section 10 of the Excise Duty Act to remove the requirement for inflation adjustment of the specific rates of excise duty to bring certainty in the excise duty regime.

- It provides for offences relating to excise stamps and their penalties.

- It introduces new section that requires operators in the betting industry to remit within twenty-four hours the excise duty in order to safeguard revenue.

- It amends the First Schedule to the Exise Duty Act to impose excise duty as follows: Imported fish at 10%; powdered juice at Kshs. 25 per kg; imported sugar excluding imported sugar purchased by a registered pharmaceutical manufacturer at 5%; imported cement at 10% of the value of Kshs. 1.50 per kg, whichever is higher.

- Further, it imposes excise duty on imported furniture excluding furniture originating from East African Community State at 30%; imported paints, varnishes and lacquers at 15%; imported non-virgin test liner; imported non-virgin fluting medium; imported cartons, boxes and cases of corrugated paper or paper board at 25%; imported plates of plastic of tariff at 25%; and imported paper or paper board, labels of all kinds at 25%.

- In addition, the Excise Duty Act excludes locally assembled motorcycles and electric motorcycles from excise duty applicable to motorcycles; increases excise duty on imported glass bottles from 25% to 35% to protect local manufacturers; increases the excise duty from 10% to 20% on imported alkyd, imported unsaturated polyester, imported emulsion VAM, imported Emulsion – styrene Acrylic, imported imported homopolymers, and imported Emulsion B.A.M.

- It reduces excise duty on fees charged for money transfer services by banks, money transfer agencies and other financial service providers from 20% to 15%.

- It increases excise duty on fees charged for money transfer services by cellular phone service providers from 12% to 15%.

- It introduces excise duty on fees charged on media advertisement on alcoholic beverages, betting, gaming, lotteries and prize competition at 15%.

- It reduces excise duty on telephone and internet data services from 20% to 15%.

- It increases excise duty on betting, gaming, lotteries and prize competition from the current 7.5% to 12.5% of the amount wagered or staked.

Amendments to the Tax Procedures Act

The Act provides for the following amendments to the Tax Procedures Act (No. 29 of 2015) (“TPA”:

- Amendment of Section 3 of the TPA in the definition of “tax decision” to clarify that the decision does not include a refund decision and to include late payment interest.

- Amendment of Section 6A of the TPA to anchor the multilateral instrument on mutual administrative assistance that Kenya has ratified in our statutes. This will enable KRA to seek help of other jurisdictions to collect tax owed to Kenyan Government in these jurisdictions.

- Amendment of Section 23 of the TPA to require trustees administering trusts to maintain and avail records required by the Commissioner.

- Insertion of new Section 23A of the TPA to provide that the Commissioner may establish an electronic system through which electronic tax invoices may be issued and records of stocks kept for the purposes of the Act.

- Introduction of new Section 32A to provide for implementation of the Convention on Mutual Administrative Assistance in collection of taxes that Kenya ratified in 2020.

- Repeal of Section 37 of TPA that provided discretionary powers for the Cabinet Secretary and the Commissioner to abandon taxes.

- Insertion of new Section 37E that provides for a one-year amnesty on penalties and interests on liabilities that accrued before 31st December, 2022 to encourage tax debtors to come forward and make payments of the principal tax and reduce the growing tax debt portfolio.

- Amendment of Section 42A to clarify that withholding VAT is applicable to registered manufacturers whose value of investment in the preceding three years from the commencement of Tax Procedures Act is at least three billion.

- Insertion of new Section 42C to provide that the Commissioner may appoint an agent for the purpose of the collection and remittance of rental income tax to the Commissioner.

- Amendment of Section 47 to allow utilization of overpaid tax for offset of both outstanding tax debts and future tax liabilities.

- Introduction of new Section 59A to provide that the Commissioner may establish a data management and reporting system for the submission of electronic documents.

- Amendment of Section 86 of the Act to provide a penalty for failing to comply with the electronic tax system.

- Introduction of new Section 97A to provide for the offence of impersonating an authorized officer.

Amendments to the Miscellaneous Fees and Levies Act

The Bill amends the Miscellaneous Fees and Levies Act (No. 29 of 2016) (“MFLA”) as follows:

- Amendment of Section 7 of the MFLA to reduce the Import Declaration Fee (IDF) from 3.5% to 2.5% to bring fairness and equity as well as ease the administration of the fees and levies.

- Introduction of a new Section 7A to introduce the export and investment promotion levy to be paid on specified goods imported into the country to provide funds to boost manufacturing, increase exports, create jobs, save on foreign exchange and promote investments.

- Amendment of Section 8 of MFLA to reduce the Railway Development Levy (RDL) from 2% to 1.5% to bring fairness and equity as well as ease the administration of the fees and levies.

- Amendment of the First Schedule to the MFLA:

—to reduce the rate of export levy on hides and skin from 80% or USD 0.52 per kg to 50% or USD 0.32 per kg, whichever is higher

—to introduce export levy on scrap metal and molasses at the rate of 20% in order to discourage their exportation

- Amendment of the Second Schedule to the MFLA:

—to streamline the IDF and RDL exemption granted to diplomatic missions

—to expand the IDF and RDL exemption granted to Kenya Defence Forces and National Police Service to include goods and material supplies in addition to machinery and equipment currently provided to facilitate security institutions for enhanced safety

—to provide IDF and RDL exemption to goods for official use by international and regional organisations that have bilateral or multilateral agreements with Kenya

—to provide IDF and RDL exemption to LPG exemption to LPG to make it affordable to Kenyans, promote clean cooking and green economy initiatives

—to provide IDF and RDL exemptions to all aircrafts and their parts to make Kenya an attractive destination for training of pilots and aircraft repairs

—to provide for IDF and RDL exemptions to bioethanol vapour stoves

—to provide for IDF and RDL exemptions to the supply of denatured ethanol

- Introduction of the Third Schedule to the MFLA to provide for rates of export and investment promotion levy to be charged on imported goods including cement clinkers, bars and rods (billets) papers and paper board at 17.5% to protect local producers of these goods.

Miscellaneous Amendments

Other Acts that are amended by the Finance Act, 2023 are the Betting, Gaming and Lotteries Act (Cap 131); Kenya Roads Board Act, 1999; the Kenya Revenue Authority Act, 1995; the Unclaimed Financial Assets Act (No. 40 of 2011); the Statutory Instruments Act (No. 23 of 2013); and the Retirement Benefits (Deputy President and Designated State Officers) Act (No. 8 of 2015).

The Finance Act also amends the Employment Act, 2007 (No. 11 of 2007) by inserting a new section 31B to impose upon each employee and employer a monthly Affordable Housing Levy whose purpose is to provide funds for the development of affordable housing and associated social and physical infrastructure as well as the provision of affordable home financing to Kenyans.

_

ayes & nays